The AI Revolution in U.S. Health Insurance: Transforming Operations Through Intelligent Automation

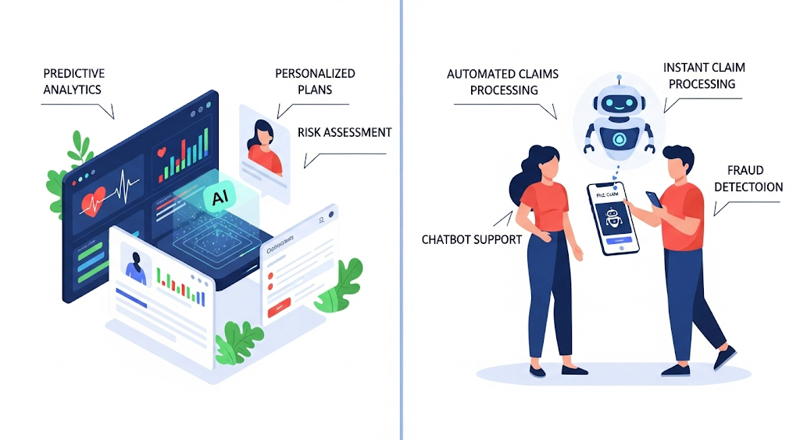

The American health insurance landscape is experiencing a profound transformation as artificial intelligence becomes integral to core business operations. From underwriting and claims processing to fraud detection and customer engagement, AI technologies are delivering measurable improvements in efficiency, accuracy, and customer satisfaction.

Today’s health insurers are leveraging machine learning, natural language processing, computer vision, and generative AI to automate complex tasks, extract actionable insights, and enhance decision-making across all business functions. The results speak for themselves: significant efficiency gains, reduced operational costs, improved accuracy, and enhanced customer experience.

Revolutionizing Underwriting with AI

AI is redefining underwriting for health plans by automating data analysis, uncovering hidden risk factors, and generating real-time insights. This means faster quotes, more accurate pricing, and streamlined operations—empowering health plans to stay agile and competitive while delivering greater value to members.

Generative AI Transforms Risk Assessment

Sixfold (Betterview) has emerged as a game-changer in underwriting automation. This generative AI platform processes large volumes of insurance submissions and creates concise underwriting narratives and risk summaries. Zurich Insurance Group’s deployment of Sixfold in their U.S. Middle Market underwriting operations has yielded impressive results, with underwriters saving approximately 60 minutes per submission while improving quote speed and accuracy.

AgentFlow (Multimodal) represents the next evolution in process automation, offering an agentic AI platform that enables carriers, brokers, and MGAs to configure AI agents for end-to-end workflow automation. The platform delivers remarkable efficiency gains, with insurers reporting 4× faster turnarounds and 80% cost reductions through straight- through processing of submissions.

Specialized Underwriting Solutions

Surefyre (Vertafore) provides a low-code/no-code underwriting workbench specifically designed for MGAs and wholesale brokers. The platform’s AI-enhanced submission intake automates rating, quoting, and candidate triage, significantly reducing underwriting backlogs and accelerating quote delivery.

Expert.ai brings advanced natural language understanding to policy and contract analysis. The platform automatically reviews policy content against coverage checklists, identifies missing clauses, and extracts key terms from unstructured documents, dramatically improving accuracy and processing speed.

Gradient AI’s SAIL™ platform combines historical insurer data with external market intelligence to create predictive underwriting models. Health insurers and workers’ compensation carriers using Gradient report shorter quote cycles and more accurate pricing through data-driven risk selection.

Streamlining Claims Processing

AI is transforming health insurance claims by automating data capture, reducing errors, and enabling faster, more accurate adjudication. Insurers can now process claims in real time, cut administrative costs, and deliver a smoother, more satisfying experience for members and providers alike

End-to-End Claims Automation

Qantev Claims Platform delivers comprehensive AI-powered claims automation for health and life insurers. The platform’s impressive performance metrics include approximately 75% straight-through processing of claims and 10% reduction in total claims costs. In fraud detection, Qantev achieves a 72% hit rate on referrals and boosts Special Investigation Unit productivity by 35%.

Sprout.ai has expanded globally to offer real-time claims decision automation for complex, multi-document medical claims. The platform can settle more than 60% of claims instantly with up to 99% decision accuracy. One major health insurer reported 23% faster turnaround times and 19% higher customer satisfaction following deployment.

Advanced Payment Integrity

Shift Technology provides specialized AI-driven payment integrity solutions for health plans. The platform’s machine learning models enhance both pre-pay and post-pay claims review, incorporating National Correct Coding Initiatives (NCCI) edits and custom plan rules. Users report dramatically increased recovery of improperly paid claims while reducing false positives.

TriZetto AI Gateway (Cognizant) represents a significant advancement in generative AI integration for healthcare payers. Launched in 2025, this framework connects TriZetto systems—serving approximately 200 million members—to secure AI agents for claims processing, care management, and service workflows, delivering substantial time savings for claims staff.

Combating Fraud, Waste, and Abuse

AI is revolutionizing the fight against fraud, waste, and abuse (FWA) in health insurance by bringing advanced analytics and real-time intelligence into claims oversight. Traditional rule-based systems often miss complex or evolving fraud schemes, while AI leverages machine learning, anomaly detection, and network analysis to uncover suspicious billing patterns, phantom providers, and unusual patient behaviors with far greater accuracy. By analyzing millions of claims and linking data across providers, patients, and facilities, AI can identify risks early—often before payments are made—dramatically reducing leakage. These tools not only enhance the efficiency of Special Investigation Units by prioritizing high-value cases but also minimize false positives, allowing legitimate claims to be processed without delay. The result is stronger financial integrity, improved compliance, and significant cost savings that insurers can reinvest into member care.

Sophisticated Detection Systems

SAS Fraud Framework for Health Care employs a hybrid approach combining rules- based checks, predictive analytics, and social network analysis to detect anomalous billing patterns. European deployments with Dutch insurers CZ and Achmea have demonstrated the platform’s ability to uncover fraudulent claims faster and with greater accuracy than traditional methods.

LexisNexis Accurint for Healthcare provides comprehensive identity and investigative services by fusing massive public records databases with advanced linking technology. The platform’s AI-driven network analysis can quickly identify suspicious relationships and flag potential phantom billing schemes early in the claims cycle.

Enhancing Customer Experience

AI is redefining member engagement in health insurance by enabling personalized, proactive, and seamless interactions across digital channels. Conversational AI tools, such as virtual assistants and chatbots, provide 24/7 support to answer benefit questions, guide members through provider navigation, and assist with claims submissions, reducing dependency on call centers. Predictive analytics further enhance engagement by identifying member needs, such as preventive care reminders or chronic condition support, and delivering timely, personalized outreach. By combining data-driven insights with natural language processing and generative AI, health plans can create meaningful experiences that build trust, improve satisfaction, and encourage healthier member behaviors, all while lowering administrative costs.

Conversational AI and Member Engagement

Sensely (Molly) offers a comprehensive conversational AI platform featuring an avatar interface that provides 24/7 member support. The platform integrates content from trusted clinical sources like Mayo Clinic and NHS to guide members through onboarding, provider navigation, symptom checking, and chronic care management.

Optimizing Risk Adjustment

AI is transforming risk adjustment in health insurance by enhancing the accuracy, efficiency, and compliance of coding and documentation processes. Using advanced natural language processing and machine learning, AI tools can scan unstructured clinical notes, claims, and EHR data to identify undocumented or missed conditions that impact risk scores. These solutions provide physicians and coders with real-time insights and evidence-based suggestions, ensuring accurate capture of diagnoses while reducing manual chart review. As a result, health plans benefit from stronger RAF scores, improved audit readiness, and optimized revenue integrity—all while reducing administrative burden and supporting providers in delivering more coordinated, value-based care.

AI-Powered HCC Coding

ForeSee Medical’s Expert Scoring Platform (ESP) uses clinical NLP and predictive models to scan complete medical records and identify diagnoses requiring risk adjustment coding. The platform works at point-of-care or retrospectively, with clients reporting that the tool “pays for itself through labor savings” while boosting RAF scores by capturing previously missed conditions.

Navina AI provides clinical intelligence that improves RAF accuracy and quality measures in real-time. The platform processes claims, health exchange data, and unstructured EHR notes to identify hidden conditions, with physicians accepting 75% of AI-generated diagnosis suggestions. Customers report over 90% physician adoption rates and consistent active usage.

Operational Excellence Through AI

Beyond function-specific applications, health insurers are deploying comprehensive AI platforms to enhance overall operational efficiency. Robotic Process Automation (RPA) tools combined with AI/ML accelerators automate back-office tasks such as data entry and eligibility verification. Decision-engine tools embed predictive models into workflows, while analytics platforms forecast utilization and guide strategic operations.

These AI-driven operational improvements deliver substantial benefits, with some health plans reporting up to 70% reduction in claims handling time after implementing RPA and NLP for data extraction. By automating routine tasks, insurers can reallocate human resources to complex, high-value activities that require personal attention and expertise.

| SOLUTION | PRIMARY FUNCTION | KEY TECHNOLOGY | MEASURABLE BENEFITS |

|---|---|---|---|

| SIXFOLD (BETTER-VIEW) | Underwriting automation | Generative AI, LLM, NLP | ~60 minutes saved per submission, faster quote turnaround |

| AGENTFLOW (MULTI-MODAL) | End-to-end workflow automation | AI agents (LLMs + RAG) | 4× faster turnarounds, ~60% cost reduction |

| SUREFYRE (VERTAFORE) | Submission intake & underwriting | Document AI, ML | Risk triage in MGAs; Faster quotes with less manual entry. |

| EXPERT.AI | Policy/claims review, contract analysis | NLP, rule-based AI | Automates underwriting; faster policy comparisons and claim adjudication |

| GRADIENT AI | Predictive underwriting | ML, predictive analytics | Better pricing decisions; shorter quote cycles; improved loss ratios |

| TriZetto AI GATEWAY (Cognizant) | Claims & care management integration | Generative AI framework | Seamless AI in TriZetto platform |

| QANTEV | Claims processing & FWA detection | ML, medical ontology, OCR | ~75% straight-through processing, 72% fraud hit rate |

| SPROUT.AI | Claims automation | ML (computer vision, NLP) | 60%+ instant settlement, 99% decision accuracy |

| SHIFT TECHNOLOGY | Payment integrity & FWA detection | ML, anomaly detection | Millions saved through reduced overpayments |

| SAS Fraud Framework (SAS) | Claims fraud, waste and abuse | ML, social network analysis | Global fraud analytics for health claims; |

| ACCURINT (LexisNexis) | Provider/patient identity verification; fraud | Graph analytics, data linking | Early fraud detection via identity linkage; flags inconsistent provider info and hidden relationships. |

| SENSELY (Mediktor) | Member engagement, triage, navigation | NLP + avatar interface | 24/7 conversational health assistant; improves engagement and self-service;. |

| FORESEE ESP | Risk adjustment (HCC coding) | NLP, clinical AI | Strong RAF lift, tool "pays for itself" |

| NAVINA AI | Risk adjustment & quality | AI engine (ML + clinical NLP) | 75% physician acceptance rate, >90% adoption |

Summary: The AI Advantage in Health Insurance

The integration of AI technologies across health insurance operations represents more than technological advancement—it’s a fundamental reimagining of how insurers serve their members and manage risk. As these tools continue to evolve and mature, we can expect even greater automation, accuracy, and personalization in health insurance services.

The success stories highlighted above demonstrate that AI is not just a future possibility but a present reality delivering tangible value across the entire insurance value chain. Organizations that embrace these technologies today position themselves for sustained competitive advantage in an increasingly digital healthcare ecosystem.

For health insurance leaders considering AI adoption, the evidence is clear: the question is not whether to implement AI, but how quickly and comprehensively to integrate these transformative technologies into core business operations.

Health Insurance CIOs / CTOs today face an overwhelming landscape of AI tools and applications, each promising unique benefits but making it difficult to identify the right fit. Agile Health Technologies simplifies this complexity by bringing deep industry expertise and proven research on AI implementations. We help CIOs evaluate, select, and deploy the most effective solutions tailored to their business goals—ensuring maximum ROI, operational efficiency, and sustainable competitive advantage. To now more about our capabilities and how Agile Health can help, please reach out to us at